Employers operating self-funded healthcare plans shoulder the ultimate fiduciary responsibility when it comes to spending health plan dollars for employee medical care. The Department of Labor aims to increase enforcement of the Employee Retirement Income Security Act (ERISA) governance on the health and welfare benefit side to meet the level of 401(k) standards in the coming years, which means employers need to ensure they understand how and where their dollars are spent.

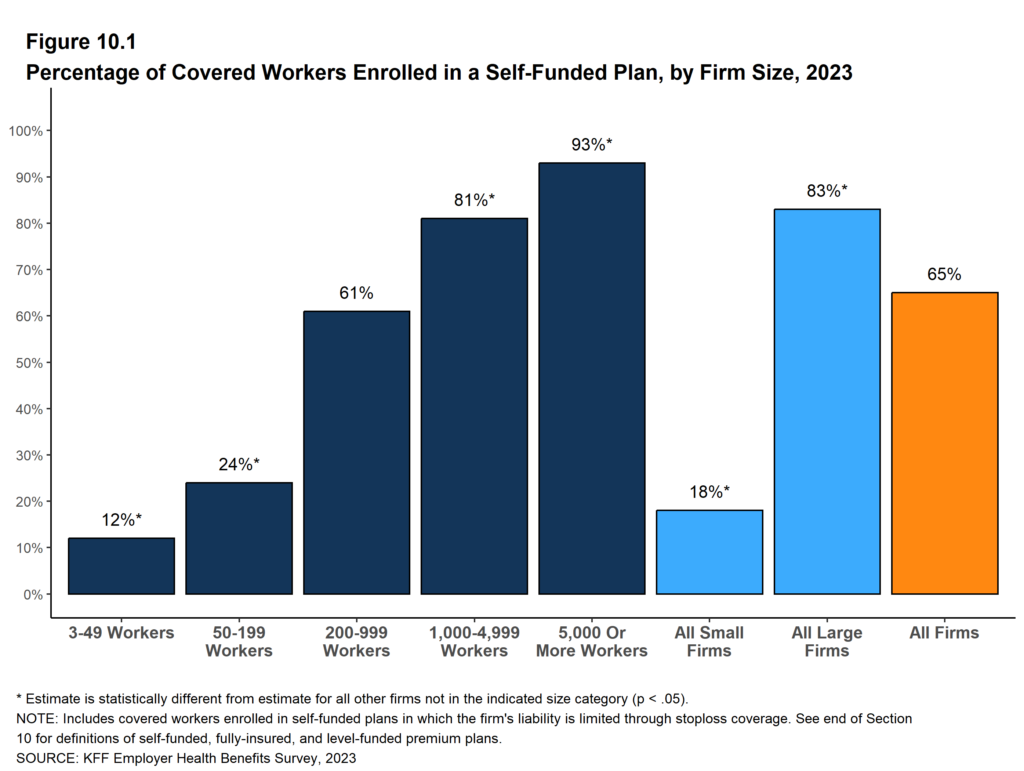

The percentage of Americans covered by self-funded employer healthcare benefit plans topped 65% in 2023,1 which means more eyes are watching how employers spend healthcare dollars – including employee contributions to their medical coverage. As the number of employees impacted rises, so do the employers’ responsibilities as fiduciaries of the plan dollars. Recent class-action lawsuits filed against self-funded employers – who serve as plan sponsors – may shape the DOL’s enforcement of ERISA.

“There is growing concern among employers that they could face litigation if they are not exercising their fiduciary responsibilities,” according to a National Alliance for Healthcare Purchaser Coalitions survey published in May 2024. The survey’s findings showed employers were primarily concerned with healthcare costs, fiduciary duties and recent litigation. “A majority of employers (69%) advocate for shared fiduciary responsibility between themselves and carriers,” NAHPC reported.2

Rory Akers, JD, Vice President, Senior ERISA Attorney for Lockton, said DOL’s enforcement of ERISA’s healthcare plan provisions will look similar to 401(k) retirement plan enforcement. Akers, a former DOL Senior Investigator for Employee Benefits Security Administration, anticipates that for some of the more novel issues, especially those related to the most recent transparency regulations, the DOL will be closely watching how the litigation plays out in the courts.

“I think this is likely to follow a similar litigation track to what we saw on the 401(k) side awhile back. Why? Because these new transparency rules that apply to health plans are similar to those heightened disclosure requirements for 401(k)/retirement plans under 408(b)(2),” Akers explained. “We’re seeing that play out right now. In my opinion, first will come lawsuits and then DOL enforcement. In my experience, the DOL has closely monitored the litigation related to these newer rules, in some instances weighing in through avenues such as Amicus briefs, and then initiate enforcement activity including litigation.”

Employer plan sponsors, as fiduciaries, must ensure ERISA-governed plans are administered in accordance with the terms of the plan documents and perform duties with the care, skill, prudence and diligence that a prudent person3 familiar with such matters would use. Additionally, fiduciaries must ensure the plan only pays “reasonable” expenses. ERISA guidelines for prudent oversight of a health plan are relatively vague, but there are best practices that not only limit fiduciary liability, but also significantly reduce the unnecessary spend in the plan assets. One recent lawsuit the DOL brought against Blue Cross Blue Shield of Minnesota involves such spending of plan assets on provider taxes.4

What the recent suit as well as previous private class-action lawsuits are doing is bringing to light the fiduciary obligation employers face. Akers emphasizes that “the buck stops with the plan sponsor” when it comes to fiduciary responsibilities involving health plan administration and operations. Yet, she understands that could be an oversimplification given the way most employers use third-party administrators (TPAs) and carriers to process and pay their claims. Employers don’t necessarily have a direct line of sight into the claims process or have insight into network provider contracts and reimbursement rates. That, she said, is what makes this more complicated.

“I have always thought that there is a lot of pressure on employers to check all of the boxes when it is difficult to get all of the needed information from their service provider partners regarding health plan spending data,” Akers said. “Don’t get me wrong, they’re required to (have access to this information) and that’s something we’re working on with our clients. We advise them to ask questions. You can’t just sit back and say, ‘Well, it’s a reputable carrier and so we rely on them.’ You have to do your due diligence.”

Akers said plan sponsors have a legal obligation as a fiduciary, but they can carve out certain administrative tasks to carrier partners, service providers or TPA’s. “But you have to watch them,” she cautioned. “You can’t just give them the keys to the car and let them drive off.” Note, ERISA includes a provision related to functional fiduciaries, those that exercise control over plan assets and/or plan administration. This could result in services providers such as TPAs and carriers being deemed fiduciaries to some extent, but that doesn’t change the fiduciary status of the employer plan sponsor.

“So, you’ve got your named fiduciary (typically the plan sponsor/employer) and then you have that functional fiduciary,” Akers explained. The carrier, TPA or service provider may not be the ultimate plan fiduciary, but they could be a plan fiduciary with regards to claims administration. If carriers or TPAs are determining medical necessity on behalf of the plan, that could be viewed as discretionary control and, therefore, fiduciary responsibility could come into play. Carriers and TPAs should be properly adjudicating claims to ensure there are no fraudulent payments, duplication of payments or wasteful spending costing the plan unnecessarily. In the past, carriers have stated within Administrative Service Agreements (ASA) with employers that they are not fiduciaries with respect to most claims administration but are fiduciaries for claims appeals.

“I question people who say the Department of Labor can’t exercise authority over these folks (carriers and TPAs) because they are not fiduciaries. I feel there are many instances where TPAs, carriers, and in some instances PBMs are exercising some level of discretionary control over claims administration and making certain claims determinations,” Akers said. Using a trucking company as an example, Akers explained that executives of that company know the trucking business, but they do not know an employee’s treatment plan or what treatments are medically necessary or appropriate for a plan participant. For that reason, they have contracted TPAs to handle those responsibilities.

“If a case related to an improperly denied or mishandled claim goes to court, I think there is a case to be made that carriers bear some fiduciary responsibility as to the claims determination,” Akers said. While employers have historically struggled to get carriers and TPAs to change their contracts away from language deferring fiduciary responsibility, the courts may be the ones to change that leverage.

SOURCES:

- “2023 Employer Health Benefits Survey,” KFF, October 18, 2023.

- “Employers Want Greater Accountability From Intermediaries to Ensure CAA Compliance per National Alliance Survey,” National Alliance of Healthcare Purchasers Coalitions, May 1, 2024.

- “Understanding Your Fiduciary Responsibilities Under a Group Health Plan,” U.S. Department of Labor, September 2015.

- Wille, Jacklyn, “Labor Department Sues Blue Cross Minnesota Over Provider Tax,” (1) (bloomberglaw.com), January 16, 2024.